INDUSTRY

Personal Finance

YEAR

2025

ROLE

UX research, concept validation, UX design, prototype testing

Project Snapshot

A founder (and former colleague of mine) approached me with an early idea for a “spending journal” to improve discretionary spending habits. The concept was promising but lacked design direction or validation. In six weeks, I transformed his idea into a validated product direction, a mindful journaling flow, and a complete Minimum Viable Product (MVP) specification ready for engineering.

My Role: Research, concept validation, IA, flows, visual direction, usability testing, MVP definition

Timeline: 6 weeks

Outcome: A validated product strategy and a clear, buildable MVP

The Core Experience: SpendLight’s Journaling Loop

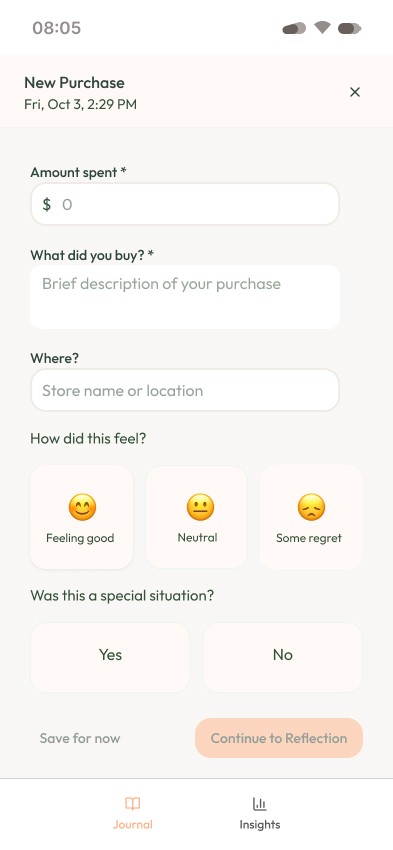

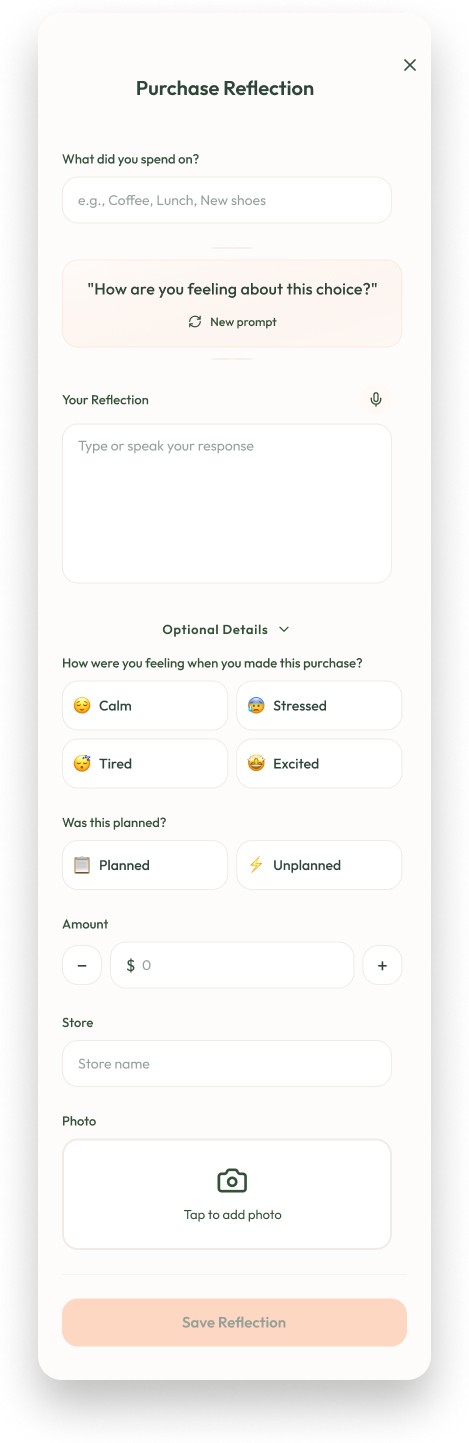

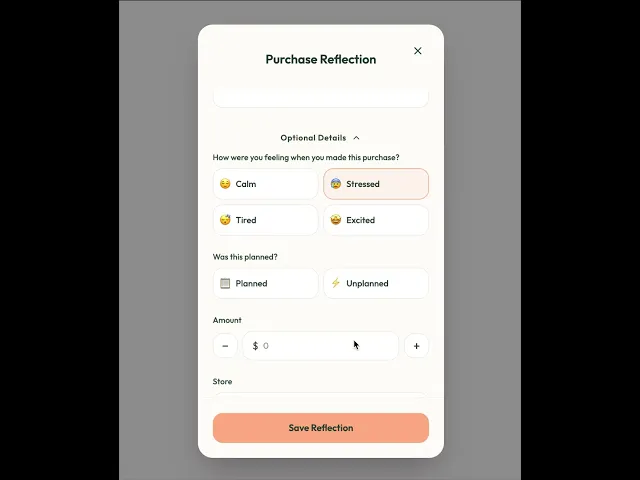

To make journaling about discretionary spending effortless, I designed a fast, calming flow built around three principles: minimal friction, emotional clarity, and positive reinforcement. This short video walks through my AI prototype from onboarding → a mood check-in → logging a purchase reflection → capturing context → receiving encouragement through the bonsai micro-animation.

The Problem

Traditional budgeting tools focus on categorization and control, which often triggers guilt and avoidance due to becoming overwhelmed or "falling behind". The people I interviewed weren’t looking for stricter budgets, they wanted emotional awareness around their discretionary spending.

The founder’s hypothesis was simple but not yet validated:

A spending journal could help people spend more mindfully, just like food journaling is a proven way to aid weight loss.

To validate this hypothesis, we needed to know:

Will people actually log discretionary spending manually?

Does reflective journaling provide emotional value?

What is the simplest possible version worth building?

My Approach

Constraints & Tradeoffs

The design sprint operated under several constraints that shaped what we prioritized:

No bank linking

The early concept focused on discretionary purchases and no-spend days, intentionally excluding bank linking to reduce friction and privacy risk. Yet early feedback was clear: “I don’t want to have to input all my transaction data!”Discretionary focus

We chose not to support full expense tracking to avoid recreating budgeting fatigue. After all, you still need to buy groceries! This narrowed the journaling experience but improved clarity.Six-week timeline

Due to time constraints we opted for parallel validation of messaging + prototype, requiring iterative decisions with incomplete data.Scope tradeoffs

Features such as analytics, social features, and in-depth coaching were intentionally excluded from MVP to keep the experience focused and buildable.

What Research Revealed (and How It Shaped the Product)

Research Methodology

Interviews

Four 45–60 min interviews with people frustrated by budgeting apps:

Household manager

Small-business owner managing mixed cash + Venmo expenses

Non-US young adult overwhelmed by micro-spending

FIRE enthusiast with established tracking systems

We explored: tracking behavior, emotional moments around money, past app experiences, and reactions to reflective journaling.

Competitive Audit

I conducted a competitive audit of budgeting, journaling, and AI coaching apps, since there were no existing & notable 'spending journal' apps.

I evaluated each for onboarding friction, data connections, logging flows, tone of voice, and how they handled emotional aspects of money (if at all).

Common patterns I chose to leverage:

Immediate insight loop – reveal a pattern after ~3–5 logs (“60 % of discretionary spend happens when stressed after 6 pm”).

Frictionless capture – single-screen log of amount, mood emoji, 140-char note.

Information Architecture & Core Experience

SpendLight needed to support a daily reflection habit without feeling like a budgeting tool. I defined a simple, habit-reinforcing structure:

Primary Screens

Home: Bonsai, emotional anchor, entry point for reflection or a quick mood check-in

Reflection Flow: Choose to reflect on a Purchase or a No-Spend day

History: Feed + calendar to review past reflections

Insights: Pattern cards revealed after enough entries

Core Loop

Add a Reflection by responding to an open-ended prompt

Add emotional context to reflection (optional tags)

Receive bonsai growth feedback

Review past entries

Unlock insights over time

This loop reinforces daily awareness, rewards consistency, and surfaces insights only once the user has enough history, keeping friction low while supporting long-term behavior change.

Testing & Iteration

I conducted two moderated usability tests using my high-fidelity prototype.

What Worked

Reflection prompts felt meaningful and calming

Emotional framing resonated immediately

Bonsai animation provided gentle motivation and a delight factor

What We Improved

Purpose clarity: Reworked onboarding to emphasize discretionary focus

Tag complexity: Kept tags optional to reduce cognitive load. Avoided giving too many options for each tag category

No-spend days: Created a dedicated flow so users felt rewarded and motivated to keep using the app even when they spent nothing

Celebration pacing: Slowed bonsai animation for better emotional impact and allowing time to read the encouraging microcopy

Insights visibility: Added insight cards directly to the feed and included a calendar picker to make it easy to review past entries

Key Testing Insight

Mindfulness works, but only when “why am I logging this?” is unmistakable. This learning shaped the final narrative, tone, and microcopy throughout the app.

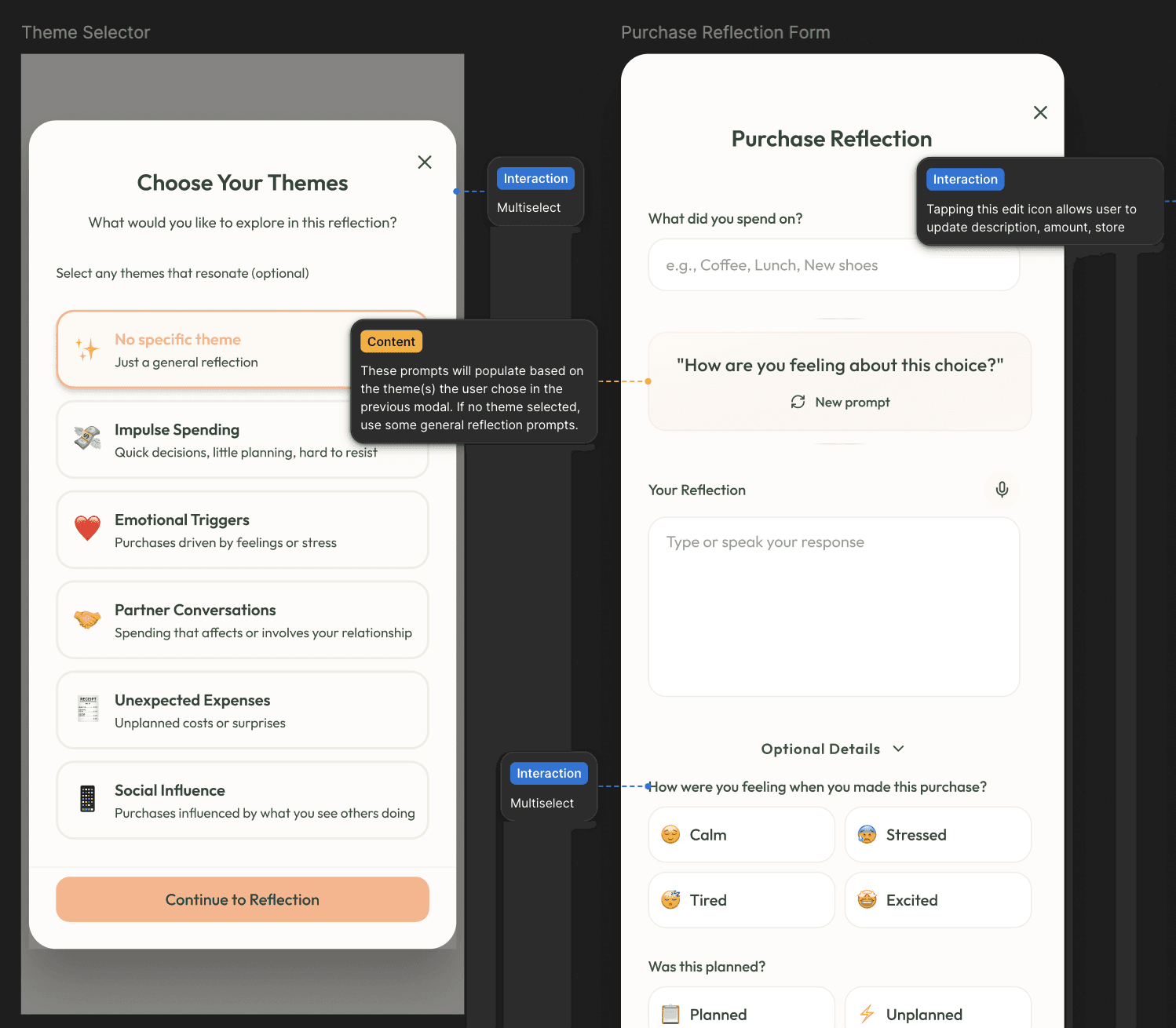

Journaling Flow Iterations

MVP Definition

The outcome of the sprint was a clear, narrow, buildable MVP focused on validating the journaling habit.

What the MVP Includes

Onboarding explaining discretionary focus

Purchase + no-spend reflections

Optional tags for reflections

Mood check-ins

Bonsai micro-feedback

History (feed + calendar)

Insights surfacing after patterns form

Intentional Exclusions

Bank linking · Analytics dashboards · Social features · Coaching modes

Engineering Handoff

I delivered:

An annotated Figma file with interaction notes

Event schema (

reflection_created,mood_logged,insight_viewed)A design brief summarizing rationale, scope, and measurement plan

This will allow the founder to begin iOS development as soon as time permits.

Impact

For the Founder

Clarity: Shifted product direction toward mindful reflection

Confidence: Validated desirability of journaling and the emotional framing

Focus: Defined a buildable MVP that reduces concept and scope risk

Speed: Equipped engineering with a complete blueprint for the first release

As the sole designer, I:

Turned an ambiguous concept into a coherent, testable product strategy

Established the behavioral mechanic (10-second reflection) that anchors the product

Translated research into IA, interactions, and tone

Reduced risk through evidence-led decision-making

Delivered a development-ready design spec

This project demonstrates how I partner with founders to create clarity, momentum, and direction.

Future Opportunities

These features could support long-term engagement, but each requires separate testing to confirm desirability.

Selectable plants tied to growth milestones

Mindful spending tips and journaling prompts

Lightweight social challenges

Experiments to support habit formation beyond week 2

Founder Testimonial

Vanessa functioned as an invaluable partner to help take a lot of scattered concepts and really develop a cohesive product concept for SpendLight. While I came to the table with a ton of possible directions, Vanessa brought us to that necessary point of convergence.

Right from the outset Vanessa was organized and methodical about our scheduled meetings and action items. She initiated and conducted several prospective user interviews, leading to important insights about the key features of our spending journal concept. Armed with that perspective, she built out several functioning prototypes so that we could run through the key user experiences.

Vanessa's work was always timely and thorough, and working asynchronously was never a problem. She was always an attentive listener, and very quickly I felt like each of our ideas were stacking one upon another. In other words, she didn't just keep her nose buried in one particular aspect of our collaboration. From the first day, she felt like a true partner in our project.

I very highly recommend Vanessa to any organization in need of excellent product development work. She functions well in the trenches and is able to surface the right conversations to decision makers to keep things moving without spending an inordinate time in the weeds. And all of this is wrapped in an outstanding work ethic and cheerful demeanor.

David Larsen

SpendLight Co-Founder & data-product engineering leader